SDM exclusive // 2021 State of the Market

“2020 was an unusual year for us,” says John Nemerofsky, chief operating officer of Sage Integration, Kent, Ohio.

Image Courtesy Sage Integration

Innovation in video solutions accelerated in 2020, and the future of the market may look even brighter than it did before the pandemic.

Video Surveillance

State Market

of the

By Courtney Wolfe, SDM Managing Editor

While 2020 affected the confidence of some in the video market, professionals remain optimistic going into 2021, with the increased adoption of new, more advanced technologies, and a potential end to the coronavirus pandemic in sight.

“We’re going to rock [2021] — this year is going to be great,” says Andrew Elvish, vice president of marketing, Genetec, Montreal. “I think a lot of the turbulence of 2020 is probably behind us. We still have a way to go before things are back to normal — likely more than a year to go. But I think the fact that we have vaccines, stimulus is being released — this is a great time.”

In the 2021 SDM Industry Forecast, conducted in the fall of 2020, 60 percent of those in the video surveillance sector rated the market as very good or excellent. Twenty-six percent rate the market as good, and 13 percent believe the market to be either poor or fair. In the 2020 report, 71 percent of video surveillance professionals said the market was excellent or very good, 20 percent said it was good and 9 percent considered the market to be fair or poor.

But while confidence was down slightly compared to the previous year before, the video sector had the highest confidence in the industry in 2020, according to the Industry Forecast.

“2020 was an unusual year for us,” says John Nemerofsky, chief operating officer of Sage Integration, Kent, Ohio, featured this month’s cover. “It didn’t flow as we thought it would with the COVID-19 crisis, but we were up about 8 percent year over year, and our video revenues were about 49 percent of our total sales.”

Stone Security, SDM’s 2020 Integrator of the Year, also reported having an unusual year.

“Overall we were relatively flat, which is abnormal for us,” says Aaron Simpson, co-founder, president and chief technology officer of Stone Security, Salt Lake City. “Stone Security has grown anywhere from 30 to 50 percent year over year for the last ten years; we were off to a really great start in 2020, and then we really kind of flattened off. It’s definitely flatter than we had wanted, but still probably at 10 percent growth for the year.”

Video surveillance systems are the most commonly offered security product or service, according to the 2021 Industry Forecast, with 78 percent of professionals currently offering video surveillance, 8 percent planning to offer video in the next one to two years, 5 percent planning to offer it in the next three to five years, and only 8 percent not planning to offer video at all.

Integrators Rate Their Confidence in the Video Market

For the past four years, SDM has asked security systems integrators how they would rate the current state of the video surveillance market.

While confidence among security systems integrators was down slightly compared to the year before, the video sector had the highest confidence in the industry in 2020.

// Source: SDM 2018, 2019, 2020 and 2021 Industry Forecast Studies

//

What Happened in 2020?

Everyone in the security industry can likely agree that COVID-19 had the greatest impact on 2020. However, all of the impacts may not have been bad.

“Ironically, the pandemic hindered and drove business simultaneously,” says Bill Brennan, president of Panasonic i-PRO, Rolling Meadows, Ill. “It hindered business due to mandated lockdowns of non-essential businesses, which limited systems integrators’ and installing dealers’ access into customers’ facilities. Many end users also suffered financially, which led to a freeze on scheduled and impending projects.

“Yet at the same time, many businesses and operations looked to implement new solutions to help them maintain compliance with new health and safety measures, so they could operate at some limited capacity and prepare for workers to eventually return to work and school. This past year presented a true dichotomy relative to sales that is unlike any other time in our history.”

While buildings were empty, some companies took the opportunity to update and modernize their video surveillance systems.

“A lot of end users took advantage of this year of less foot traffic to do a lot of capital investments and upgrades to their security systems,” Elvish says. “We also saw a lot of attention being put into modernizing physical security systems — this year allowed security professionals to say this is our chance to really make that leap.”

Elvish adds that more sophisticated end user spaces, such as oil and gas, property management, retail and airports, as well as data centers and tech companies, really drove business this year with the updates they made to video systems.

Jeff Burgess, chief executive officer of BCD International, Buffalo Grove, Ill., says manufacturers’ ability to build and ship solutions was a key factor throughout the pandemic. He credits his supply chain team — which was able to decrease shipping times from eight days in March to under four days in November — for the company’s increase in revenue in 2020.

While revenues didn’t end up where most were predicting this time last year, integrators and manufacturers of video products remain optimistic.

drbimages/ E+/via Getty Images

“We were hindered somewhat by installation facilities being closed, but we started to see an uptick in projects reopening for installations by Q3 2020,” Burgess said.

Tim Palmquist, vice president, Americas, Milestone Systems, Lake Oswego, Ore., believes the video market was hindered by two things in 2020: “The first was the installers and system integrators not having access to end user facilities — this was a new twist we had not seen before,” Palmquist says. “The other was a reallocation of end users’ budgets to facilitate alternative needs. For example, in the education vertical, many schools turned to remote learning versus focusing on the physical protection of their facilities. They shifted their budgets in response to the impacts of COVID-19 and restricted access to their schools.”

Customers’ demands for more and more cameras also drove business in 2020.

“It’s always shocking, but there’s a constant demand for more [cameras], especially in these days when people are away from their facilities,” Simpson says. “A lot of our customers also want more proactive solutions and notifications, so their cameras are more of an asset.”

The improvement in analytics capabilities brought a great deal of attention to the video market last year, as many companies relied on them to safely remain open.

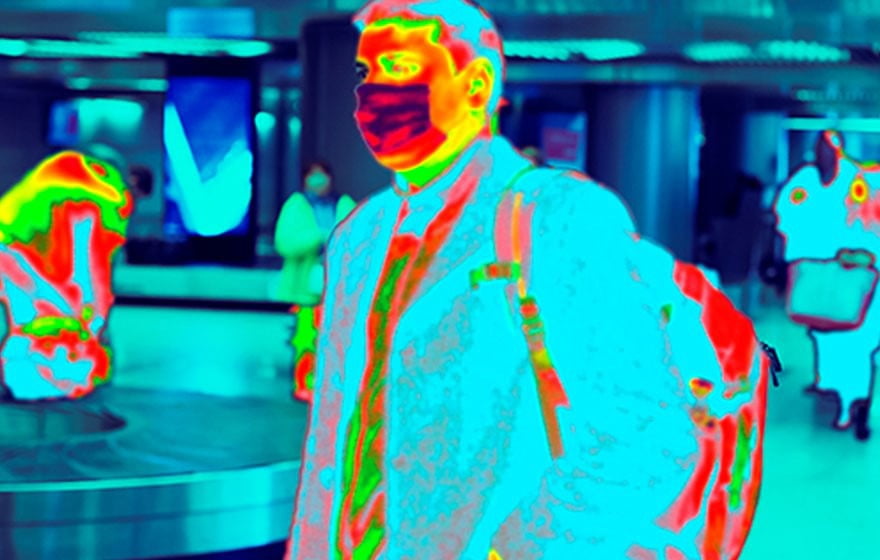

Taking Advantage of Opportunities in Thermal

While sales were down in other areas of the video sector, many security professionals clung to the shining bright hope that thermal cameras promised to bring during the coronavirus pandemic. Everyone was talking about them — politicians, health experts, business owners small and large — and the fact that they fell under the umbrella of physical security brought a great deal of interest to the industry.

“Video surveillance benefited greatly from temperature monitoring systems,” says Anna Sliwon-Stewart, senior analyst and research manager, security and building technologies, Omdia, London. “If they couldn’t sell their traditional systems, they could sell these and do very well. In a post-pandemic world, you’re trying to think about how you can make an office space work again.”

Security & Safety Things’ Fabio Marti says that solutions involving temperature detection were — and continue to be — sought after by companies of all kinds in order to help employees and customers return to businesses.

“As we advance towards post-pandemic life, industries will be searching for ways to resume business or continue to adjust to pandemic protocols and regulations,” Marti says. “Some of these technologies, which weren’t new to our industry, moved into the mainstream spotlight — opening up opportunities in new markets.”

Soon after the pandemic began, all kinds of manufacturers started releasing products claiming to detect high temperatures, but not all delivered on their promises. For security systems integrators and dealers, testing and wading through the different options more than filled the time left open by a slowdown in surveillance installations.

//

John Nemerofsky of Sage Integration says he did more thermal deployments than ever before in 2020, which helped the company increase its revenue by around 10 percent compared to the year before. This changed how they sell video surveillance systems, and required more training for employees.

“We’ve done a lot of training with technicians on video solutions, and we continue to see analytics and thermal deployments as major parts of that [training],” Nemerofsky says.

As Sliwon-Stewart points out, the first thermal cameras deployed at businesses had a wide range of acceptable temperatures, making them unreliable in detecting whether a visitor had COVID-19.

“This meant the emergence of a new type of product that is a camera and thermal detection device in one,” Sliwon-Stewart says. Now, in the best applications, temperature detection is considered a part of a whole security system. The sensor detects the person’s temperature, the camera takes a picture of their face, and depending on what the temperature reading is, access rights on mobile phones or cards can be automatically revoked.

While a high temperature isn’t the only or necessarily best way to detect whether visitors and employees have COVID-19 — some who contract the virus are asymptomatic with no temperature at all — it’s easy to see how this sort of technology will continue to be used by businesses after the coronavirus is over. Cold and flu season often hits entire offices or schools hard, and temperature detection solutions could be even more efficient when combatting these illnesses.

Read our story on integrators’ experiences with elevated skin temperature detectors for more.

“It almost goes without saying that while the market as a whole suffered, like most industries, from the effects of the COVID-19 pandemic, the opportunities presented by video analytics and smart cameras became vital to resuming business,” says Fabio Marti, vice president of marketing, Security & Safety Things, Munich, Germany. “The ability to run AI-enabled analytics directly on embedded devices to solve problems at the edge enabled many to get back to work in a safe and secure manner, using occupancy management technologies, upholding social distancing guidelines and, in some cases, deploying temperature detection.”

Some companies looked to managed services to boost sales in a tough year — an idea that organizations like PSA have been stressing for years.

“We’ve made a good pivot and are now offering a lot of options around video hosting, interactive video solutions, health monitoring, password monitoring and maintenance,” Nemerofsky says.

According to the SDM Industry Forecast, 62 percent of security professionals currently offer remote video monitoring, and 56 percent offer Video Surveillance as a Service (VSaaS). At least three in five companies that are not currently offering managed/cloud-based services expect to begin offering remote video monitoring and/or VSaaS in the next 12 months.

3.4

The average number of networked cameras in U.S. households with security systems.

// Source: Parks Associates

“The pandemic has disrupted so much of our lives, but for systems integrators, the disruption has been around the normal cycle of deployments and the uncertainty influencing the buyer’s cycle,” says Srinath Kalluri, CEO of Oyla, San Carlos, Calif. “This has made it harder for systems integrators to count on equipment installs and has forced them to look for other ways to meet sales and revenue goals, like adopting a more service-based mindset.”

Jeremy White, founder of Pro-Vigil, San Antonio, agrees that the recent economy has led to an increase in the adoption of managed services.

“In a down economy, or as unemployment rates rise, companies look for ways to reduce expenses without scaling back their security strategy,” White says. “It’s the perfect scenario for VSaaS. For example, a commercial property management company might be dealing with more vacancies than ever before. They need to protect these buildings, but they just don’t have the revenue coming in. Video monitoring is a strong play there.”

The security needs of the fast-growing Cannabis industry also helped integrators through 2020.

“The largest trend for us here in Massachusetts is the quickly growing Marijuana market,” says Paul Verruto, sales manager, Wayne Alarm, Lynn, Mass. “This is providing a great deal of opportunity in the enterprise surveillance market.”

Jason Burrows, regional sales director, Western U.S., IDIS America, Coppell, Texas, says, “Our high-end retail and hospitality customers were hit particularly hard by COVID-19 lockdowns, which inevitably saw a drop off in new projects and upgrades. However, our focus on the thriving Cannabis sector has continued to pay dividends; we saw a spike in Cannabis sales during the first March lockdown in California as many dispensaries are now viewed as essential retail.”

Majority Expect Revenue From Video & Analytics to Increase

SDM asked, “How do you expect revenue from video surveillance systems and video analytics to change in the next year?”

Of those surveyed for SDM’s Industry Forecast, 58 percent expect revenue from video surveillance systems (on-premise and cloud-based) to increase, 32 percent expect it to remain the same, and 11 percent expect revenue to decrease. When asked about video analytics, 55 percent said they expect revenue to increase, 40 percent expect consistency and only six percent expect revenue from video analytics to decrease.

// Source: SDM 2021 Industry Forecast Study

//

Analytics

Besides the coronavirus pandemic, 2020 will likely be remembered by those in the video sector as a year in which technology improved at a record pace. And while many of these new technologies were developed with COVID-19 in mind, the advancements made will continue to drive innovation in video surveillance for years to come.

“From a technology perspective, we see open-platform integration continuing to stimulate true convergence supported by more advanced AI-driven edge devices and software platforms, including intelligent analytics,” Brennan says. “From an application perspective, compliance and risk mitigation are now more top-of-mind than before because of the pandemic, which further compounds liabilities on many different levels. All these factors will combine to help drive a strong recovery in the physical security market.”

According to SDM’s 2021 Industry Forecast, 34 percent of security professionals consider the video analytics market to be very good or excellent; 33 percent consider it to be good; and 33 percent consider the market to be fair or poor.

“Intelligent video analytics powered by deep learning are positioned to enjoy steady growth in 2021,” Burrows says. “As computational power has increased, they’ve become increasingly easier to deploy and use, as well as more cost-effective and accurate. And users are choosing from a variety of options to harness the power of AI and its benefits. Edge-based cameras are a popular option because users can benefit from metadata even without applying analytics rules to speed up investigations, while processing analytics on the edge results in reduced bandwidth usage.”

Video analytics can be useful when working with customers with lower budgets — a factor that becomes increasingly important amid shrinking security budgets, says Bill Fitzhenry, chief sales officer, Bastion Security, Portland, Ore.

“We leverage technology to cost-effectively manage risk and solve real business issues,” Fitzhenry says. “For this reason, we’re technology and manufacturer agnostic. That said, AI-powered video analytics and hosted cloud technologies have been incredibly useful in extending the scope of protection we’re able to offer.”

Ed Pedersen, vice president of sales, security integrator and distribution channels, Bosch Building Technologies, Fairport, N.Y., says the possibilities with video analytics are virtually endless.

“Deep learning-powered video analytics will continue to gain adoption both via devices with embedded analytics and through standalone analytics software licenses,” Pedersen says. “The development of AI and deep learning, and the impact that this technology will have, will drive growth and technological development for the video surveillance industry. The ability to convert unstructured video data into meaningful insights will move the video surveillance industry into the IoT world.”

“Ironically, the pandemic hindered and drove business simultaneously.”

— Bill Brennan, Panasonic i-PRO

The introduction of more processing power at the edge is also making these next-generation analytics more scalable and easier to deploy, according to Pedersen. This, coupled with the open architecture of new hardware platforms, is broadening the base of developers and enabling far more diversity in the tasks that technology can perform.

And, as video cameras collect more and more data, the demand for AI and analytics will continue to grow.

“As the security needs of users continue to change and grow, this means that security operators are faced with the obstacle of keeping up with managing an increased amount of data and insights; on top of that, most people have shorter attention spans that decrease over time,” says Alex Asnovich, head of global marketing, video security and analytics, Motorola Solutions, Chicago. “However, AI can help to overcome these challenges as it can analyze a significant amount of video data more efficiently and effectively than humans ever could. It is designed to bring the most important events and insight to users’ attention, freeing them up to do what they do best, which is make critical decisions.”

Pro-Vigil deployed AI across its entire customer base in August of 2020; and in 2021, White says the company will be able to sort through all of the data being collected to help customers make better business decisions.

Security Professionals’ Perception of the Video Analytics Market

SDM asked, “What is your current perception of the video analytics market?”

While the majority (67 percent) of security professionals surveyed for the Industry Forecast consider the video analytics market to be good, very good or excellent, 33 percent aren’t so sure, rating the market for video analytics as poor or fair.

// Source: SDM 2021 Industry Forecast Study

//

“2021 will be a year of moving from proactive to predictive,” White says. “Traditionally, security has been reactive — someone breaks in, you go back and watch the tape to see what went wrong. Now, with AI systems learning from the enormous amount of data generated from security cameras, Pro-Vigil is moving into a new paradigm of predictive security, where weather conditions, time of day and the direction someone is walking, for example, could help predict an attempted crime before it ever happens.”

Government-funded projects will likely be the largest vertical application for video analytics, Pedersen says, due to city surveillance projects. The development of business intelligence and safety applications will also generate a considerable increase in use cases for this technology, as commercial end users focus on analytics for non-security applications.

“Proactively managing risk is now more important than ever for end users,” Fitzhenry says. “Whether it’s growing transient activity, increasing property crime or more general concerns (especially in urban environments), stopping criminal activity before the action occurs is critical.”

3 in 5 Plan on Offering Remote Video Monitoring or VSaaS in the Next Year

SDM asked, “Which managed or cloud-based services do you currently offer and plan to offer?”

Sixty-two percent of security professionals currently offer remote video monitoring, and 56 percent offer Video Surveillance as a Service (VSaaS). At least three in five companies that are not currently offering managed/cloud-based services expect to begin offering remote video monitoring and/or VSaaS in the next 12 months.

// Source: SDM 2021 Industry Forecast Study

//

The Cloud

Brad McMullen, general manager, 3xLOGIC, Fishers, Ind., is one of many security professionals that predicts the cloud will help the video market rebound in 2021.

“Cloud-managed video systems are being embraced, and with a lower cost of entry for these systems, customers can determine how they want to manage their video solutions — on-premise, cloud or hybrid solutions,” McMullen says. “These solutions enable customers to scale their video solutions as needed, add or remove storage space when required, add features and benefits on-demand and pay for exactly what you use.”

Nemerofsky says that while he initially saw success with the cloud in markets such as senior living and property management, he now frequently sees the cloud in use at corporate headquarters as well, especially with so many employees working from home during the pandemic.

“Cloud solutions have been tossed around and talked about for a while now,” says Miguel Lazatin, senior director of marketing, Hanwha Techwin America, Teaneck, N.J. “I think now it’s becoming more of a reality because the obstacles and the cost can be more easily overcome than maybe several years ago.”

Megapixels, Audio & More

Analytics and the cloud aren’t the only technologies on video professionals’ radars — higher camera megapixels, IP intercoms and audio are also affecting the way integrators sell and install surveillance systems.

“The product mix is ever-changing — when we talk about cameras, 1080p used to be the standard resolution, but now 4K is becoming the norm,” White says. “We have to make sure that we’re staying nimble and flexible in order to deploy technologies that can adapt and grow as the industry rapidly evolves.”

Nemerofsky says that more customers are demanding cameras with higher megapixels, which means they get better views with even fewer cameras.

Analytics helped boost video sales in 2020, as capabilities such as mask and fever detection became must-haves for a variety of businesses.

IMAGE COURTESY OF HANWHA TECHWIN

IP intercoms and audio solutions are also in greater demand than they were a year ago, according to Fredrik Nilsson, vice president, Americas, Axis Communications, Chelmsford, Mass.

“Two of the most promising technologies right now include IP intercoms and IP audio solutions,” Nilsson says. “Today’s market is analogous to the IP video market a decade ago. Great opportunity exists for new applications and installations, as well as the prospect of converting the abundance of existing analog systems.

“As users realize how exponentially powerful their network security system can be by combining intelligent audio and intercom with other technologies like IP video, access control and analytics, adoption will accelerate.”

And while it will be exciting to see how video continues to grow in the next few years, McMullen cautions integrators when considering all of these new and emerging technologies.

“With new technology and solutions launching monthly, integrators need to stay educated on the benefits and challenges of new solutions, and they must understand which solutions are proven and if they truly solve the problems their customers are looking to solve,” he says.

Video Surveillance Systems are the Most Commonly Offered Security Product

SDM asked, “Which products and services do you currently offer or plan on offering?”

Video surveillance systems are the most commonly offered security product or service, with 78 percent of professionals claiming to currently offer video surveillance, 8 percent planning to offer video in the next one to two years, 5 percent planning to offer it in the next three to five years, and only 8 percent not planning to offer video at all.

// Source: SDM 2021 Industry Forecast Study

//

Cybersecurity & Privacy Concerns

Cybersecurity and privacy concerns surrounding video surveillance were put under a microscope like never before this year.

“More and more companies, governments and cities are looking for physical security systems that can ensure the privacy and integrity of the area and people they are protecting,” says Andrew Elvish of Genetec. “Privacy continues to be something that sets companies apart, and companies need to choose their vendors carefully.”

Bill Fitzhenry of Bastion Security says that while cybersecurity should have always been a concern for integrators, it is more top of mind now that end users are coming to them with privacy concerns.

“We’ve always designed systems with cybersecurity in mind, and have implemented training and best practices to secure endpoint devices as well as core systems,” Fitzhenry says. “What’s changing now is that clients have a greater awareness of cybersecurity threats and the potential impact of new providers or systems on their network, so we’re more proactive about discussing cybersecurity early in the project.”

//

Working closely with clients’ IT and security groups is essential when installing systems that could put users’ privacy at risk.

“We engage with the IT group with every customer, we always have — if we didn’t have their sign-off on every project, it would be a nightmare,” says Stone Security’s Aaron Simpson. “Typically they have policies and procedures in place, so we refer to them while making recommendations based on manufacturers’ hardening guides. We’ve also encouraged our manufacturers to be secure by default so the camera comes out of the box secure.”

Frederik Nilsson says that Axis has always been 100 percent focused on cybersecurity, actively monitoring for common vulnerabilities and exposures.

“Since the cyber landscape is constantly changing, cybersecurity is an ongoing process of assessing risks and taking action,” Nilsson says. “It requires constant vigilance around products, people and technology. Accordingly, we have stringent processes in place at every level of the value chain, from design and manufacturing to suppliers and distribution.”

The company is particularly proud to be one of only a few manufacturers with its own system-on-chip, which enables built-in security for Axis cameras, so only secure, authorized firmware can be installed.

The National Defense Authorization Act (NDAA), which went into effect in 2020, also put an increased focus on cybersecurity, as integrators were no longer able to use surveillance products from Chinese manufacturers due to their perceived untrustworthiness.

“Because of the NDAA, I think the supply chain was somewhat under a microscope, so a lot of customers were really looking for partners and brands with very sound and solid cybersecurity practices, that are known to be dedicated to securing their devices,” Hanwha Techwin’s Miguel Lazatin says.

Hanwha has been showing efforts to become more cyber-secure for close to a decade, and the company is especially excited about the release of its latest chipset, the Wisenet 7, which is secure by design.

Jeff Montoya, regional sales director for the eastern U.S., says that IDIS has also understood cybersecurity risks early on, as far back as 2013.

“We never designed in ‘backdoors,’” he says. “Many development engineers thought these backdoors were cleverly hidden tools that simply allowed manufacturers to use hash functions to undertake factory resets. But if the hash function is leaked, the result can be a major security breach. This has meant that, unlike [some] other vendors, we’ve never had to back engineer or rebuild the trust among our systems integrator partners and dealers, or customers and IT departments.”

To eliminate risks, IDIS has taken a zero-configuration approach since the late-‘90s. Its flagship DirectIP offering acts as a mutual authentication system whereby cameras and NVRs authenticate each other. The data is automatically stored on camera and NVRs, eliminating the need for manual passwords which might be saved in vulnerable spreadsheets, or written down where others could find them.

ComNet is attempting to help integrators maintain user privacy with the Port Guardian, a feature that automatically disconnects the port on a switch if it senses a disconnection.

“It’s a simple and highly effective tool that absolutely prevents an outside hacker from getting into your network from an external location,” Skip Haight says. “That feature is being added to many more ComNet switches and media converters.”

Another ComNet product, the Link Guardian, limits network traffic to one-way communication between the source and destination networks, preventing cybersecurity attacks from a non-secured entry point in the network from reaching a secured part of the network.

But regardless of what manufacturers do to make their products cyber-secure, it is ultimately up to the security systems integrator to install these products in a way that protects the privacy of the end user.

“The biggest challenge that continues to be huge is cybersecurity and being able to effectively communicate with your end users about cybersecurity in a way that’s informed and proactive is an absolute must for every single integrator in the business — I don’t care if they sell to a pizzeria or the biggest bank,” Elvish says. “We are implementing complex IoT systems, and we need to be aware of the risks that poses not just to the end user using that system, but the wider network we are installing it on. We need integrators to, for their own interest, become better at this, but many are putting cybersecurity to the fifth or sixth spot on their priority list. We really need to step up our game.”

What to Expect in 2021

As of late January, even though new year had begun, most of those in the video market were still unsure of what exactly to expect in 2021.

“No one knows how COVID-19 will impact us in 2021 or how long the vaccination process will take to finally end the pandemic — obviously, the sooner it ends, the better for business,” White says. “We’re also watching how new entries into our industry shape the market moving forward. While competition is a challenge, it’s also an opportunity because it will educate decision makers on the solutions available.”

Frank ‘Skip’ Haight, vice president of marketing, Communication Networks (ComNet), Danbury, Conn., warns of possible supply chain issues affecting the market in 2021.

“In the manufacturing sector, the availability of components is going to be an issue; and in the supply chain, getting those components that are important to the manufacturer of products has been affected,” Haight says. “The components of our products come from manufacturers globally — if any of those factories were shut down for any period of time, that affects delivery and production on our end.”

Because of this, Haight recommends security integrators start the purchase process for projects as early as possible.

Burgess of BCD International also predicts supply chain issues will affect the way integrators do business in the coming year.

“Integrators are likely going to refocus and reemphasize their product lines more than we have ever seen,” Burgess says. “Genetec integrators will not carry other lines, Avigilon and Milestone integrators will do the same. Their challenge will be how to widen their existing product offerings while expanding their touchpoints within their existing accounts and finding new customers to deliver their solution.”

As the technologies in the video market continue to evolve, so will the supply chain, and it’s up to security systems integrators to determine where they will fit.

The Importance of Standards

While standards have not always been a popular notion within the physical security industry, their importance continues to rise year over year as end users demand unification and integration between product vendors.

“For many years, the physical security industry was inundated with proprietary architectures, and these closed standards hindered hardware implementations, and to that point, hardware innovation,” says Jeff Burgess of BCD International. “Security vendors based their purchase of hardware on the quality of warranty offerings and support. Today, information technology teams are much more involved and engaged, and leading the charge by demanding open standard implementations of physical security implementations.”

Milestone’s Tim Palmquist says that right now, standards do not play a significant enough role in the industry. However, Milestone saw the importance of being open and partnering with the community in 2020.

“Winning in 2020 was more complicated than it ever was before,” Palmquist says. “When COVID-19 disruptions set in, we were able to leverage unique innovations from other manufacturers in our marketplace to win key projects. By being open, we were able to assemble the right partnerships and deliver the most value to the end user, overcoming many obstacles along the way.”

Genetec has also benefitted from its open architecture, but Andrew Elvish would like to see more standards throughout the industry.

“Unification is the number one promise to end users,” Elvish says. “As we look more broadly into the industrial Internet of Things, unifying those devices through standards to talk to devices within the industrial IoT really is a big game changer for all sorts of industries, especially critical infrastructure and large-scale manufacturing.”

//

Motorola Solutions actively uses and promotes open standards, and throughout the past five years, the company has made progress in the adoption of ONVIF for interfaces between cameras and video management systems.

“With the release of ONVIF Profile T in 2018, adoption by the industry and utility customers has continued to increase,” Motorola’s Alex Asnovich says. “Avigilon is proud to offer ONVIF Profile S, G and T support on our video management system and almost all of our cameras. In fact, Avigilon was the first, and still remains one of the few companies that has no native protocol for our cameras — we use only ONVIF protocols and, where none exist to support the offered functionality, ONVIF extensions.”

Asnovich predicts the continued development of ONVIF will gradually eliminate the need for proprietary camera interface protocols.

In 2020, ONVIF announced a new release candidate for Profile M, a specification that is vital to the standardization of video analytic applications and IoT connected devices.

“In terms of market potential, Profile M will bring a number of opportunities for smaller, innovative companies in the analytics space and for end user freedom of choice,” says Per Björkdahl, chairman of ONVIF’s steering committee. “By standardizing the communication of metadata amongst devices and clients, Profile M provides the possibility for integration into IoT systems, with a way to link devices such as IP cameras into building management and other business intelligence platforms.”

Björkdahl adds that Profile M was designed to meet the demands of the current market as the number of smart applications for security, business intelligence and IoT devices drive interoperability demands.

“Standards are huge drivers and facilitators of innovation that offer unique ideas,” says Fabio Marti of Security & Safety Things. “They have changed industries, effectively normalizing the basic elements of a system and allowing resources to be spent on developing new features, functionalities and ideas. When open and standardized platforms are utilized, efforts can be instead focused on innovation to benefit a variety of industries. From the camera manufacturer side, they are able to better focus on innovating hardware and image processing. Ultimately this benefits all parties involved — integrators, manufacturers and end users.”

ONVIF is planning on releasing the final version of Profile M later this year , which will standardize the communication of metadata and event handling for analytics — a notion that will become even more important in 2021.

“In the coming months of 2021, integrators are likely going to be tasked with customizing solutions for end users that can assist in pandemic-related issues,” Björkdahl says. “We’ve already seen this on the access control side with an increase in demand for touchless and contactless solutions. If anything, this has renewed the importance of standards. Without them, integrators will find it that much more difficult and resource-intensive to offer end users a flexible, cost-effective security solution, as they won’t be able to pick and choose what products fit the client’s needs best for both COVID-19 uses and beyond.”

“Being informed and educated on how to add value throughout the chain [will be a challenge for integrators this year],” Lazatin says. “For integrators, it’s about how they adapt and recalibrate their business and figure out in the face of things like cloud solutions, what their role is within that value chain. I think it’s imperative for resellers to maybe not think about what made them successful in the past, but the future of this industry and what technology is driving it, and understanding how to add value and be a consultant to end users.”

While the first quarter or half of 2021 may start out slow, manufacturers and integrators alike are expecting business to pick up as coronavirus vaccines are more widely distributed and facilities start to reopen.

“We are forecasting second half 2021 revenues to be up 166 percent greater than the first half,” Burgess says. “There are still a lot of moving parts on the vaccine distribution and the potential of additional strains and spikes as we are seeing globally, which could cause the return to closing facilities again, repeating delayed installation. We expect 2021 to be similar as to how we started 2020, again riding the momentum of the last four months of the year. Hopefully, this time we will be able to continue to build from that foundation the balance of the entire year.”

49%

The percentage of security professionals concerned about supply chain management as the pandemic persists.

// Source: Axis Communications

Stone Security, like other integrators, took advantage of the slowdown in business last year to improve internal operations and processes, preparing them to take on a massive backlog of projects.

“We’ve seen no canceled projects, but a lot put on hold, so the biggest opportunity is making sure we’re back in front of the customer and getting those flowing again,” Simpson says. “That backlog is just a floodgate ready to burst. The biggest challenge has got to be the concern of how quickly things will open up, and how quickly customers will be receiving visitors. The unknown there is our biggest challenge right now.”

Axis has also been preparing for a pent-up demand of video products, and believes that a variety of factors will lead to a successful 2021.

“A pent-up demand, the need to kick start stalled projects and a business community that’s eager to get back to normal will help the industry hit the ground running as the pandemic subsides and the economy fully reopens,” Nilsson says. “As businesses look to regain ground lost in 2020, a healthy balance sheet will be more important than ever. Business owners will become more discerning as they look for investments with a solid return — and that means getting the most out of their network security technology. Our industry is poised to respond with proven solutions that help meet health and safety requirements, improve security and enhance business operations.” SDM