WHOLESALE MONITORING

How 3rd-Party Central Stations Answer the Call to

Help Dealers Thrive

Acadian Total Security sold its wholesale monitoring business to AvantGuard Monitoring Centers in 2021. The company continues to monitor its own alarm accounts.

IMAGE COURTESY OF ACADIAN TOTAL SECURITY

Wholesale monitoring executives discuss trends, technologies and services that dominate today’s monitoring ecosystem and where independent security dealers can find success.

By Rodney Bosch, SDM Senior Editor

Look no further than the affiliation between wholesale monitoring centers and security dealers to affirm the famous adage, “two heads are better than one.”

In an industry undergoing intense disruption — fueling unprecedented revenue opportunities and, for some, suffocating competition — harnessing the strengths and abilities of a third-party monitoring provider is one of the most strategic ways for dealers to grow their installation and service portfolios while solving difficult business challenges.

Gaining new customers and revenues are among many reasons for forming — and maximizing — partnerships with a wholesale central station. Those relationships could mean dealers will have access to new products and services, receive much-needed training, reach new markets, enhance competiveness and combat attrition with increased customer loyalty.

SDM spoke with executives from several leading wholesale monitoring providers to discuss their role in helping dealers achieve success and buttress their organizations against ever-changing market headwinds, as well as some of the dealers taking advantage of these relationships. Ahead they pinpoint hot products and services, RMR strategies, what more dealers can and should be doing to maximize their partnerships, plus examine the factors pushing dealers to shutter their own monitoring centers.

Developing Products to Heighten Customer Experience

One area where wholesale central stations are leading their security dealer partners into the future is through product development and enhanced customer experience. An expansive range of monitored services are being brought to market that leverage the cloud, video, IoT technologies and more.

“One of the things that we really understood a number of years ago, this concept of customer support, customer service, customer satisfaction, net promoter scores — it all boils down to a customer experience — and whoever provides the best customer experience is going to be king,” says Morgan Hertel, vice president, technology innovation, Rapid Response Monitoring, Syracuse, N.Y. “In other words, if you can’t keep your customer base happy and not looking, they’re not going to be with you for very long. And so we started looking at what does that really mean?”

Custom Alarm staffs its Customer Experience Center with its most tenured personnel who formerly served in the company’s monitoring center. Custom Alarm began contracting with a third-party central station in 2020.

IMAGE BY DEAN RIGGOTT PHOTOGRAPHY FOR SDM

About four years ago Rapid Response began internal discussions to examine what exactly consumers want. What do they need from their security and monitoring provider? What are their expectations?

“They all want to consume data differently,” Hertel says. “They want to be contacted differently. They want to be emailed or SMS’d or phoned or a combination of those in a specific order. They really want you to be uber flexible. There has to be a methodology and ways to do that. And one of the things that we came up with is this concept of ‘dynamic workflow.’”

One of the fruits of the company’s deliberations was bringing to market rapidSMS, a custom-engineered, dealer-branded app solution that takes inputs such as video, audio, time, temperature, weather, among others, and sets up rules to vary the workflow based on these inputs. A link in the rapidSMS message takes a dealer’s end customer to an interactive window on their mobile device, allowing them to respond to an alarm with push-button controls. Customers can cancel a false alarm, request an emergency dispatch, chat with other contacts, contact the monitoring center or send the dealer service inquiries.

“So the idea was, let’s take information that we can know — whatever that happens to be, like who just arrived or who just left — and bundle that together,” Hertel says. “And let’s start making better decisions, calling people differently and having different kinds of conversations with them. It changes the outcomes of the conversations. It reduces false dispatches, and the consumer ultimately wins because they had a better conversation. And when they have a better conversation, a better interaction, then the dealer keeps a happy customer.”

Woodie Andrawos, president, NMC, Lake Forest, Calif., explains as competitiveness has grown, homeowners and businesses have more options, which is pushing dealers to adopt emerging technologies that will drive more interest and revenue. This trend is a major factor why NMC has been diligent in keeping up with the needs of the market, Andrawos says.

Key Factors Pushing Dealers Out of the Monitoring Business

Simple economics is altering what has long been a lucrative business model in the alarm business. Increasingly, many independent security dealers are finding it near impossible to justify continuing to operate their own monitoring centers.

Troy Iverson of AvantGuard Monitoring Centers ascribes two big challenges in the monitoring space that are creating more central station shutdowns and acquisitions.

The first is the challenge of providing subscribers with a better experience while maintaining or reducing costs. “Dealers that operate their own central stations face issues with finding and retaining good employees in an extremely competitive job market with significant wage increases due to inflation,” he says.

Secondly, he cites fast-paced progress in advanced monitoring technology, which makes it difficult for smaller central stations to keep pace.

Larger wholesale centers are simply better positioned fiscally to provide today’s advanced services that consumers expect and desire, says Jason Caldwell, director, marketing and business development, Immix, a central station automation software provider. There is a certain threshold that dealers need to be at in terms of the number of accounts to operate a truly profitable monitoring business. And if you’re small, Caldwell says, it can be very difficult to justify those margins.

“It costs money to make money. Some of these smaller entities really just have always been focused on the traditional burg and fire monitoring, and they really don’t have the capability to truly differentiate themselves and offer these enhanced managed services,” he says. “So they’re losing business because they can’t provide them. That’s what’s leading to a lot of attrition that you’re seeing in the industry.”

In early 2021, Acadian Total Security of Lafayette, La., decided the time had arrived to get out of the third-party alarm monitoring business. By August of that year a deal was consummated with AvantGuard.

“It was a pretty big undertaking for us,” says Brandon Niles, Acadian’s senior director. “At the time we had 120,000 alarm accounts; 25,000 of which belonged to Acadian Total Security, and the rest of them were dealer accounts we were monitoring as the wholesale side of our business.”

While there were several factors that went into Acadian’s decision to exit the wholesale alarm business — the company continues to operate a third-party video monitoring unit — the biggest factor for Niles was it became too much “keeping up with the wholesale big boys.

“They are able to invest a whole lot of money into technology and finding ways to get more efficient in handling alarms,” Niles says. “Whereas, we as a midsize monitoring company didn’t have that level of sophistication that they did. Our costs just continued to creep up. Our employee costs, our receiver line costs and just the overall maintenance costs were creeping up and up.”

Another big contributor to Acadian’s decision to sell derived from the increasing number of dealers who wanted to negotiate better pricing. They may have been having success signing on new dealers, but they were having to lower pricing for other existing clients.

“This is just my gut — I don’t have data to back it up — but I do feel like the DIY disruption that the industry has been talking about for many years started to impact a lot of the dealers we were monitoring,” Niles suggests. “Maybe they weren’t offsetting attrition or they weren’t able to go get $40 a month and they have to settle for $30. As a result, they started looking at their vendors as a way to offset some of that cost. It really just became a leveling act that wasn’t looking great for my company. And so that is ultimately why we ended up deciding to sell.”

Custom Alarm in Rochester, Minn. (SDM’s 2022 Dealer of the Year) is an example of an independent security provider that successfully ran its own monitoring center for decades prior to moving to Affiliated Monitoring in late 2019.

For Melissa Brinkman, CEO of the family-owned company, the decision was fraught with some anguish. Founded in 1968 by her father, Leigh J. Johnson, Custom Alarm’s connection to the greater Rochester area has always been deeply rooted. Monitoring their own customers’ accounts was a highly personalized endeavor. Yet business dynamics would dictate the company’s decision-making.

Brinkman explains there were three main factors. Even before the pandemic, fully staffing the third shift consistently was made ever challenging due to constant turnover. Custom Alarm was also having ongoing reliability issues with its automation software provider following a transition from on-premise servers to cloud-based.

“And then third was just having to continuously upgrade our technology to be able to support the infrastructure and maintain competitiveness and offering our customers the most up-to-date technology and services,” she explains.

Crunching the numbers validates the company’s decision. Overall, Brinkman says their cost per account is less by using a third-party provider.

“We did an analysis of our overall costs when we considered doing this. Our highest turnover area was our dispatch center. So overall we’re paying hard revenue out against our recurring revenue, but it is a savings and we feel like we can really focus on what we need to focus on,” she says. “So it’s a win-win. We might be paying out some of our RMR dollars, but they were buried in with our costs of running that department before.”

Four of Custom Alarm’s most experienced monitoring center operators remain with the company to staff its Customer Experience Center. The group continues to provide a personalized touch for customers in need of troubleshooting, putting systems on test, dispatch follow-up calls and the like.

“Rochester is a big town but a small community. There’s a bit of that losing a personal touch that people feel compelled to share with me. But overall I feel like we are providing better quality service and security for them in the long run,” Brinkman says. “And so it’s just having to adjust to change for our customers. We are here for them and we respond. Even though we’re not doing the dispatching ourselves, we are here to help them in every other way.”

“Security dealers can provide their customers with additional services and value-adds to their monitoring service,” he continues. “NMC is in a great position to provide our dealers with services that will increase the RMR and reduce attrition ranging from our video solutions to customer-facing apps and tools that help create the complete end-user customer service experience.”

As AvantGuard Monitoring Centers continues to grow aggressively, Troy Iverson, senior vice president sales and marketing, says the Ogden, Utah-based company remains intensely focused on the development of product and services innovations and making significant investments in training and account management solutions.

“We understand that our dealers face growing pains, staffing issues and other resource challenges,” Iverson says. “As a true business partner, we continue to develop technology solutions that create more efficiencies, cost savings and tools to help dealers grow their business. We even encourage our dealers to offer feedback and recommendations on our solutions so we can become better and long-term partners.”

Among the variety of ways that Hagerstown, Md.-based Dynamark Monitoring is supporting its dealer partners is by providing them more free software tools to help run their business, says President Trey Alter.

“These tools and additional services we offer help them reduce the staff they need in the office and allow them to focus on growing their business instead of being trapped in it,” he says “With so many dealers suffering from staffing shortages we have also been offering enhanced support services to help them fill in gaps where they may be short on office staff. We can backfill some of these needs and help them keep the business running smoothly.”

“Talk to your monitoring provider. That’s a big part of it. A lot of dealers don’t. A lot of them just sort of plod away and do their thing, and they don’t really ever have any conversations with the central station. Some dealers are very connected, but most of them are not.”

— Morgan Hertel, Rapid Response Monitoring

With a 45-year history serving the marketplace, COPS Monitoring President Jim McMullen says the most fundamental way the Williamstown, N.J.-based company helps its dealers succeed is by helping them protect their bottom line by ensuring they keep the RMR they already have.

“Providing excellent service in our dealers’ names not only helps to retain RMR by upholding their hard-earned reputation, it can also lead to customer referrals and new revenue,” McMullen says.

He continues, “Another way we help our dealers grow is by integrating with the leading revenue-generating services that are in high demand from their customers and by offering our services at competitive rates so our dealers can realize greater margins and compete with the industry giants. We also teach them how to leverage these services through in-person training and frequent webinars.”

Leveraging Video for Value-Add Services, Verification & More

Video surveillance as a service (VSaaS) solutions such as proactive video monitoring and alarm monitoring services — utilizing automation tools to create a better user experience — are two of the top monitoring solutions in the security industry today due to demand for scalable, adaptable solutions that work for any business, Andrawos says.

“In addition, these services are seeing constant improvements and integrations that benefit a broader customer base across various industries,” he says.

Implementing the latest software as a service (SaaS) solutions for video and alarm monitoring is always a great way to increase monthly revenue for service providers, Andrawos adds. “By offering the latest technologies and service offerings, dealers can serve customers better and continue building upon their consistent stream of income further improving the predictability of their business.”

VSaaS has been a huge growth area for Dynamark and its dealer partners, Alter says. The company has a dedicated video team that works with dealers to train them on best practices for installation and pricing. (Go here to learn more how VSaaS is driving new business for dealers and integrators.)

“We were seeing that so many dealers wanted to make the leap to selling recurring video services but did not know where to start,” he adds. “We have helped them standardize deployment and pricing so that it can be scaled to add significant incremental RMR.”

AvantGuard uses video platforms to send signals to the monitoring station for video verification, which speeds up the intrusion-verification process and dramatically reduces the potential to incur false dispatch fees.

IMAGE COURTESY OF AVANTGUARD

Steve Mayer, vice president operations and administration, Emergency24, Des Plaines, Ill, cites video verification as a top technology offering for dealers. For years, he says, the industry has been discussing the rise of video as a key solution for protecting people and assets while ensuring verified events for first responders. And now the time is ripe.

“Video verification solutions such as ChekT are a key tool for new standards ensuring appropriate dispatch of first responders. This reduces the risk of harm to your customers, their assets and our first responders,” he continues. “Emergency24 has partnered with ChekT to offer an expedited video verification service for alarm installers to leverage.”

To be more accurate and efficient, AvantGuard uses video platforms to send signals to the monitoring station for video verification. It speeds up the intrusion-verification process and dramatically reduces the possibility of false-dispatch fees. “Video verification efficiencies are another selling point dealers can use with subscribers to increase alarm accuracy while increasing their RMR,” Iverson says.

AI and machine learning represent additional up-and-coming technologies that can and will make positive sweeping changes across the security industry as well as many others, Iverson explains. They have the potential to improve user engagement and provide unique solutions to complex health and safety problems in the workplace and at home.

“AvantGuard’s parent company, Becklar, has created an intent-based platform that is powered by AI called Engage,” Iverson says. “Our exclusive Engage platform provides inbound and outbound event responses through multiple channels including voice, text, SMS and more. AG utilizes the Engage platform to understand user intent and respond more quickly and appropriately based on the interactions.”

Key Strategies for Ramping Up RMR

As Mayer points out, 2022 was a tough year for most industries struggling with a severe supply chain squeeze and out-of-control inflation. Still, businesses with a diversified recurring revenue stream have felt less pain. Dealers and integrators that remain resistant to adapting, he says, will be in for an even more prolonged period of financial straits should the economy fall into recession as some foreshadow.

“As we all know surveillance technologies and the software platforms that support them are becoming more and more advanced,” Mayer says. “They provide turnkey solutions that make it easier for dealers and integrators to deliver impeccable service to their end users. But what will set them apart and elevate one over the other will be the quality of customer service and reputation; meaning, person-to-person interaction and that experience leading to positive word of mouth.”

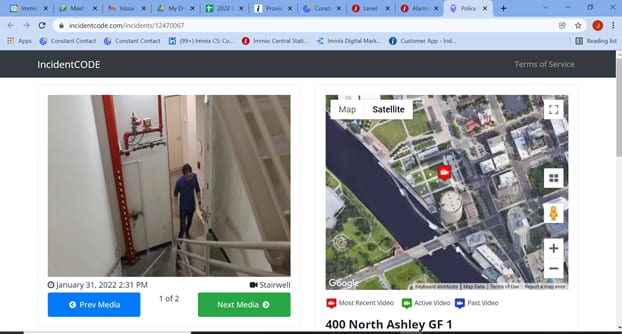

Third-party monitoring centers are advancing their service and alerting capabilities with automation software integrations. Software provider Immix allows central station operators to select alarm clips that demonstrate suspicious activity for real-time sharing.

IMAGE COURTESY OF IMMIX

He adds, “Providing a fast, personalized level of end-user communications as opposed to the typical method of service requests using online forms or automated voice messages when calls are made by customers makes a tremendous difference when it comes to their satisfaction and retention.”

Alter says he tries to encourage dealers to focus on creating solutions instead of selling products. “In security especially, customers will pay far more when they know your solution alleviates a problem they are experiencing,” he explains. “Selling solutions allows you to charge for your services every month instead of simply at the point of sale. If you want to increase RMR you need to be adding value every single day.”

Jeff Cohen, president, Quick Response Monitoring Services, Cleveland, explains if a customer trusts you with their physical security and fire, they will likely trust you with other types of security offerings like network and cybersecurity, cloud-based access control and systems monitoring. “It is valuable to research, learn and develop quality offerings in these spaces to allow you to provide your customers with end-to-end protections, all within a recurring revenue model,” he says. “Look to partner with complementary businesses to add to your offerings.”

McMullen believes security dealers need to be open to new ideas, products and services and not be afraid of introducing new ideas to existing customers. “Dealers set in their ways on equipment and service selection — or complacent with their existing customer base — will almost certainly run the risk of losing customers to companies offering the newest technology,” he says.

Up until recently, one RMR-generating segment in particular that has been neglected is the whole home network, Hertel says. Traditional-minded alarm dealers have mostly ignored the segment, but now find themselves having to install cameras, video doorbells, audio speakers and other gear throughout the residence based on customer expectation.

“Now all of a sudden for dealers who try and rely on consumer-managed Wi-Fi and Ethernet networks, it just doesn’t work anymore. Those things are constantly changing,” Hertel says. “They have no control over those networks. And it becomes a service nightmare for them. And so what’s happened in the past is most dealers just don’t want to touch it because it doesn’t make sense to them.”

Dealers are increasingly being forced into having to provide a holistic approach to home networking. To stay relevant and competitive, many residential providers find themselves having to play catch up and amend their portfolio to include offerings such as mesh networking and Wi-Fi to manage the network and make sure security appliances are working.

Reaching Customers How They Want to Be Reached

A call comes into a customer’s smartphone; maybe they pick it up, but more likely these days they don’t. A text message lands on that same smartphone and it is almost assuredly going to be read within mere seconds, if not a few minutes. Statistics illustrate how lopsided texting vs. phone calls have become: Nine out of 10 people read the texts they receive within the first three minutes, and 90 percent of customers prefer text messages over phone calls.

Dealers must heed the reality of today’s consumer communication preferences and leverage readily available SMS and two-way chat features offered by their third-party monitoring providers.

“Believe it or not, SMS is probably the most impactful, least expensive, least difficult service offering that central stations offer today — that have the largest positive feedback from customers,” says Jeff Cohen of Quick Response Monitoring Services. “An overwhelming number of consumers don’t answer their phones, even when they know who it is. People are quick to reply to a text message. This holds true for their alarm systems as well.”

Technology that reduces false alarm dispatches represents one of the biggest opportunities in the industry today, and SMS is one application that is being increasingly leveraged to combat unwarranted dispatches, says Troy Iverson of AvantGuard. False alarms are more than just an inconvenience or annoyance — they cost nearly $2 billion each year for law enforcement agencies, he cites.

“AvantGuard’s AG Chat tool enables subscribers to use a text thread with their ECVs to determine alarm validity,” Iverson says. “Since response rates to text are much higher than phone calls, AG Chat has grown into a solution that many of our dealers use as a selling point to subscribers while simultaneously reducing false alarms nationwide.”

According to Trey Alter of Dynamark, developing the functionality to cancel and verify alarms via SMS was pioneered several years ago by his company, which made it a free standard offering. “It has not only cut down on false alarms but also had a meaningful impact on attrition for our dealers,” he adds.

In 2022, COPS launched MYALARM.CHAT, which utilizes SMS and secure chatroom technology to improve alarm verification success rates by communicating with customers the way they prefer. Additionally, explains Jim McMullen, the company’s chat service improves customer satisfaction by giving them the tools they need to get the response they want.

“What I mean by that is customers can use MYALARM.CHAT to share information with their designated parties in real time to make more informed decisions about their security, then they can either cancel the alarm right from the interface or escalate police response by telling us to bypass all verification calls,” he adds. “We’ve seen a remarkable 65 percent reduction in police dispatch when MYALARM.CHAT is combined with electronic cancel sent from the alarm panel. This is not only beneficial to customers, but it also has a big impact on emergency services and the industry as a whole.”

“There is nothing worse than having the internet go down in a household,” Hertel says. “Everybody just goes dark. The TV stops working. Work stops. Kids start screaming. It’s a mess. What you are going to see is dealers are going to be forced into managing that.”

And therein lies the potential for new revenue and stickier customers. Step outside your comfort zone, embrace the opportunity and make the investment necessary to succeed. Even cybersecurity and ID theft protection as a service are increasingly being supported by some wholesale monitoring providers that dealers could be offering their clientele.

“No. 1, you will become much more of a provider than you ever did before,” Hertel says. “But also the incremental revenue is pretty decent when you start looking at that.”

Are You Maximizing Your Monitoring Provider Relationship?

So you’ve made a business decision on who you will entrust to monitor your alarm accounts and provide that special sauce to make your customers feel contented in their moment of need. But are you taking full advantage of the training and service offerings, among other business support, that your wholesale partner likely provides? Dealers may be surprised to learn many of among their ranks do not. Money is being left on the table.

There is no rocket science to apply here. Getting the most out of your relationship with your monitoring provider begins with a simple act, advises Dynamark’s Alter.

“Start by picking up the phone and giving them a call. Dynamark and other top tier stations invest a lot of resources in people, training and programs specifically to help dealers,” he says. “A good place to start is asking yourself if you are taking advantage of all that is currently available to you. At Dynamark if you call in asking for help you will get it that day.”

Hertel at Rapid Response shares very similar advice.

“Another way we help our dealers grow is by integrating with the leading revenue-generating services that are in high demand from their customers and by offering our services at competitive rates so our dealers can realize greater margins and compete with the industry giants.”

— Jim McMullen, COPS Monitoring

“Talk to your monitoring provider,” he says. “That’s a big part of it. A lot of dealers don’t. A lot of them just sort of plod away and do their thing, and they don’t really ever have any conversations with the central station. Some dealers are very connected, but most of them are not. Unless we really nag them and bug them and track them down, most of them don’t have a lot of communication with wholesale centers.”

Being disengaged can be detrimental in terms of not taking advantage of attaining a deeper understanding about new products and services.

“Most dealers either seem to not have time or are not engaged enough to pay attention,” Hertel continues. “We see that a lot, and I hear that from other centers as well. A lot of them have really good programs that are available and trying to get dealers’ attention is tough. They are busy, but this is their livelihood.”

Mayer stresses the key to Emergency24’s strong and enduring partnerships with its alarm dealers and integrators is an open dialogue and awareness of emerging technologies and solutions. The company provides ongoing training for current and new customers to ensure accounts are set up to reduce costs and risks.

“The open dialogue and information-sharing help us understand how to best serve you and your customers,” he says. “We acknowledge that emerging technology has made initial setups and maintaining accounts more complex than ever. Our team handles these challenges by providing personalized support for you and your customers throughout the lifecycle of your customer accounts.”

As with any business relationship it is imperative that dealers develop a true partnership with their monitoring center, Iverson says. Lack of transparency is a common reason cited by dealers who come to AvantGuard from their competitors, he adds. “We strive to be proactive with correspondence to dealers about new services that can help accelerate growth, as well as potential challenges that may affect their businesses.”

Engaging in two-way communication — such as listening to and acting on feedback from dealers — ultimately helps the monitoring center provider better service.

“This has resulted in improvements like reorganizing our customer service team into small groups so support specific issues including onboarding, conversions, medical/PERS, video verification and dealer services,” Iverson says. “These groups have assisted in creating faster responses and higher quality services for our dealers.”

He adds, “Pricing, technology, redundancy and culture are must-haves that dealers should look for, but transparency through empathy and open communications helps maximize long-term relationships with monitoring partners.”

SMS and two-way chat services provided by third-party central stations are helping to significantly reduce false dispatches while creating stickier customers for dealers.

Charday Penn/E+ via Getty Images

At NMC, Andrawos says they’ve learned that when both partners ensure a high level of support is a priority for all involved, both brands experience greater success and pride in knowing they are helping build a joint vision with shared values.

“Creating and sustaining strong industry partnerships with like-minded businesses that share the same ideals — while simultaneously growing over time — results in increased value and higher levels of service and support delivered to all parties,” he says. “Dealers having a close partnership and relationship with their monitoring center is key to continuing to learn of the new services and innovations being brought to the marketplace by their monitoring center partner.”

COPS’ McMullen also recommends that dealers interact with their monitoring companies regularly, and recognize what a great resource they are given their many affiliations. “We’re highly involved in the industry,” he says. “We have many relationships with distributors and service providers, and have exposure to best practices from thousands of successful alarm companies nationwide.”

Cohen of Quick Response Monitoring Services advises dealers to understand that their third-party central station is not just simply a vendor. Instead, think of them as a critical part of your success.

“The central station can make or break a dealer depending on customer service. Most post-install communication between the end user and the dealer flows via the central station,” he says. “Think of, and treat, your central station as the business partner they truly are.”

He also stresses don’t get stuck invoking “tradition” as the answer. Take advantage of the service offerings your central station has, especially if those offerings are designed to improve efficiencies or re-align existing business practices with industry best practices.

“This will ultimately lead to improved customer satisfaction and profitability,” Cohen says. MT