SDM exclusive // 2023 SDM 100

Solving the Labyrinth

Labyrinth

the

Solving

Labyrinth

the

Solving

Treedeo/Creatas Video via Getty Images

SDM 100 companies reported a wide variety of experiences in 2022, very much depending on the path, location and unique set of challenges that made up their business conditions last year. As a group, however, they continue to rise to the challenges put before them and find their individual path to success.

By Karyn Hodgson, SDM Editor

This year’s SDM 100 companies’ answers when asked to describe their business success in 2022 were truly a puzzle. As soon as one would say “best year ever” another company would describe the market as “flat.” Some said supply chain issues were quickly resolving, while others predicted they would still loom large in 2023. And some described certain technologies or markets as very strong — residential or commercial, fire or video, for example — only for the next company to say the exact opposite.

No. 9, Pye-Barker Fire & Safety, which realized 155 percent RMR growth over 2021 and moved up the rankings from 15 last year, described 2022 as “ the strongest I’ve seen in my 15-year career.”

No. 37, Peak Alarm Co., was also bullish on last year, but with more cautious notes, writing, “The market was strong in 2022 with a surge from pent-up demand left over from COVID and supply chain issues of 2021. We saw all sectors increase spending in the beginning of the year, with the end of the year starting to flatten due to the impacts of inflation and concerns with the overall market. We still experienced long backorders in our fire side of the business, and that definitely kept a lid on our revenues for that sector. However, increased demand for camera systems, access systems and burg helped lift our sales overall. Peak Alarm’s greatest accomplishment in 2022 was being able to rise above the one-two punch of inflation and workforce shrinkage to come out with stronger than expected financial results.”

2023 SDM 100

No. 1 – Closed a $1.2 billion equity investment by State Farm in October 2022. Acquired IOTAS in June 2022 and Denver-based Key-Rite Security in May 2022. SDM’s 2017 Dealer of the Year. No. 2 — Launched as Securitas Technology in March 2023 after completing its acquisition of STANLEY Security in July 2022. No. 3 – Partnered With Denovo to grow summer sales program in January 2022. No. 4 – SDM’s 2003 and 2015 Dealer of the Year. No. 5– Acquired Security Source in April 2023 and Netronix Integration in March 2023, its two most recent in a string of ongoing acquisitions in 2022 and 2023. Changed name to Pavion from CTSI in October 2022. No. 6 – SDM’s 1998 Dealer of the Year No. 7 –SDM’s 1999 and 2013 Dealer of the Year. No. 8 – SDM’s 2000 and 2019 Dealer of the Year No. 9 – Pye-Barker continues its acquisition streak with close to 20 acquisitions in 2022 and so far in 2023, including current SDM 100-ranked companies Sonitrol of SW Ohio (ranked No. 35 this year) and Amherst Alarm (ranked No. 44 this year), both purchased in March 2023 (after the submission date for the 2023 SDM 100), as well as 2022 SDM 100 ranked Briscoe Protective (No. 20) in September 2022, and B Safe (No. 29) in April 2022. No. 10 – Partnered with Alarm.com to bring Proptech to the multifamily market in December 2022. No. 13 Sealed three deals to grow in North America and beyond in June 2022. Acquired Hawaii-based Star Protection Agency in May 2023. No. 14 – Debuting on the SDM 100, Zeus was formed in 2021 as a platform business to partner with fire safety and security operators in selected markets. Partnered with Independent Alarm in January 2023. No. 15 – Acquired Homeguard Security in March 2023 and Dream Systems’ Security Division in August 2022. Named Five-Diamond Certified by TMA in June 2022. No. 16 – SDM’s 1984 Dealer of the Year. No. 18 – TSI was able to grow revenue by over 27 percent and added several Fortune 500 clients, as well as multiple new IDN’s in the Healthcare space. Merged with Securitronics in October 2022. No. 19 – Completed its merger with Titanium Solar and the acquisition of its security portfolio. No. 20 – Added its 7th branch location, and 4th out of state company, expanding its presence in the New England region. Acquired Malfy Alarm of Cape Cod in January 2023. No. 23 – Made two acquisitions. SDM’s 1997 Dealer of the Year. No. 24 – Completed a 2½ year cell radio replacement effort. No. 28 –SDM’s 2020 Dealer of the Year. No. 32 –SDM’s 2018 Dealer of the Year. No. 33 – Completed the unification and rebranding efforts of two acquired entities (purchased in 2021). Paladin Technologies acquired VTI Security and Spectra Audio Design Group, adding 350 new colleagues to the team. Ranked on the SDM 100 for the first time. No. 35 – Acquired by Pye-Barker in March 2023. No. 39 – Acquired Electronic Systems Group in May 2022. No. 44 – Acquired by Pye-Barker in March 2023. No. 46 – SDM’s 2004 Dealer of the Year. No. 47 – Acquired another company (Maine-based Inlution) while changing over both its CRM and financial systems internally to move systems into the cloud, both running concurrently. Rebranded in January 2023 No. 60 – SDM’s 2021 Dealer of the Year. No. 61 – Purchased a new headquarters building in 2022 that triples its space with plans to renovate it in early 2023. No. 62 – Increased RMR and IR by 20 percent organically last year. No. 64 – Completed the Ina A. Colen project, a $2.4 million K-8 charter school. No. 65 – Acquisition of another company that expands Alert Protective into another location providing further service abilities. No. 68 – At the beginning of 2022, Brad Wilson, RFI’s COO/president, passed away unexpectedly. The senior leadership team, which had been in place since 2019, pulled together to lead the company to have its best year ever. No. 71 – Started a solar division as a bolt-on to its security company with adoption rates that exceeded expectation. No. 72 – Received TMA Five Diamond status for its central station. No. 73 – Successfully completed the 3G communicator upgrade project prior to the sunset(s). No. 74 – At the end of the year had its highest revenue and highest profits to date. SDM’s 1995 and 2022 Dealer of the Year. No. 75 – Ranked on the SDM 100 for the first time. No. 80 – Increased overall operating margin year over year by 275 percent. No. 81 – The acquisition of Carehawk Inc. in Ontario allows JSC to integrate the Canadian manufacturing business with its U.S. distribution business. No. 83 – The purchase of Mid South Security gave KMT a second office and more internal people to continue to grow with. No. 84 – Ranked on the SDM 100 for the first time. No. 85 – Largest increase in RMR with minimal attrition. No. 88 – Grew RMR by 20 percent. No. 89 – Integrated 60 percent of its internal systems by converting its data to an extensive CRM platform. No. 90 – Ranked on the SDM 100 for the first time. No. 93 – Purchased 500 accounts. Ranked on the SDM 100 for the first time. No. 95 – Completed all radio conversions. No. 96 – Had the highest revenue year in its 40+ year history. No. 97 – Migrated 80 percent of its clients to 4G/LTE communications. Ranked on the SDM 100 for the first time. No. 98 – Had the biggest year of sales bookings and booked over 35 percent more in 2022 than they did in 2021. No. 99 – Exceeded revenue goal by 11.5 percent and increased gross profit margins to 53.9 percent. No. 100 – Upgraded all of its fire and intrusion alarm system radio communicators with the 3G/4G to new LTE radios.

Peak Alarm’s greatest accomplishment in 2022 was being able to rise above the one-two punch of inflation and workforce shrinkage to come out with stronger than expected financial results.

— Peak Alarm

No. 96, LVC Companies, however, found just the opposite, writing, “Early in 2022 the market was sluggish as opportunities slowed in mid-2021 due to the continued pandemic challenges, so the fallout was more realized in early 2022. As the pandemic slowed, we saw an increase in opportunities in mid-2022. It started out weaker than hoped but continued to get stronger as the year progressed. Best was video surveillance and card access opportunities, although supply chain hindered revenue. Intrusion was sluggish. Supply chain and logistics, including additional tariffs and fees, were difficult to navigate as there were constant and consistent changes happening. All impacts related to the pandemic caused margin erosion due to the unknown changes before, during and at time of proposals and well after contract execution.”

While companies more focused on commercial customers generally seemed to have more positive experiences, that wasn’t always the case.

The table above presents aggregate figures for the SDM 100 group of companies, which are ranked by their recurring monthly revenue (RMR) — an industry standard of valuation of a security installation/monitoring business. Most of the SDM 100 companies are privately held. Submitting RMR is required for ranking; other figures are not required, but mostly provided. Most companies — but not all — also reported their total annual revenue, number of subscribers, installation revenues, employees and acquisition activity. Therefore, one should exercise caution in using this information to extrapolate industry totals or to benchmark. Note that some figures — such as total annual revenue, subscribers, and residential and non-residential sales revenue — fluctuate from year to year due to both acquisitions and inconsistent reporting by the ranked companies. Every effort is made by SDM to maintain consistency in reporting.

// Source: 2023 SDM 100, SDM Magazine, May 2023

SDM 100: 5-Year Snapshot

Recurring monthly revenue (RMR) in 2022 for SDM 100 companies slipped 5 percent to closer to 2020 levels. Still, 91 percent of companies reported some RMR growth in 2022. While five out of the top 25 companies reported lower RMR than 2021, most of the declines were minor and a few had very strong growth. Stand-out companies among the top 25 in RMR growth are: Pye-Barker Fire & Safety, with 155 percent; AMP Smart with 43 percent; Tech Systems Inc. at 18 percent; Kastle Systems, 15 percent; and Guardian Alarm Company, 11 percent. Two companies were unable to report their previous year RMR numbers, but would represent a large increase: Securitas Technology, which completed its acquisition of STANLEY last year; and Zeus Fire and Security, which formed in 2021 and is reporting for the first time.

// Source: 2023 SDM 100, SDM Magazine, May 2023

SDM 100 RMR Down 5 Percent to $668 Million

Total SDM 100 recurring monthly revenue (based on 12/31 in $ millions)

For example, No. 80, Vortex 1 Security, wrote: “The market was relatively soft during the year compared to 2021. We did put a larger focus on CCTV and access control sales during the year and that was our biggest growth during the year. We did not see any impacts from COVID-19, and supply chain issues got better as the year went on. … I think inflationary concerns within the economy held back our residential customers from spending like they have in the past.”

No. 83, KMT Systems Inc., however, described both residential and commercial segments as strong, adding: “We grew in residential sales from year over year, organically along with two acquisitions. The major increase was in commercial sales. We as an organization will be focusing on more SMB and enterprise sales for 2023 forward.”

Of course, there are always differences in experiences due to size, region and business focus, but last year added extra challenges on top of the past few years of upheaval, leading each of these companies to find new paths when coming across an obstacle on the one they were on.

This was especially true of those hardest hit by supply chain shortages. Many found themselves searching out new manufacturing partners, new ways of doing business with their customers and storing more stock than they ever had to before.

SDM 100 companies are ranked here by the amount of their sales/installation revenue from non-residential projects. Note that some larger companies and those that are very active in the non-residential market are not ranked because such detailed information was not publicly available or they did not report it to SDM. Companies that reported less than $300,000 in sales/installation revenue are not included in this ranking.

// Source: 2023 SDM 100, SDM Magazine, May 2023

Top Companies Ranked by Non-Residential Sales & Installation Revenue

No. 74, Custom Alarm, SDM’s 2022 Dealer of the Year, wrote: “Supply chain issues are continuing to impede, more so on the scheduling aspect. Due to not receiving all the necessary parts for a job, we are not able to complete jobs in their entirety, causing multiple return trips not budgeted into the job, and also preventing us from billing a job complete and collecting. This puts a cash crunch on us as a company and erodes our profitability. … We navigated through the challenges of staffing, supply chain compounded by pricing increases by our manufacturers causing us to change some product offerings. We started working with some new partner manufacturers, which required training of our technical staff during our most busy year yet. At the end of the year, we had our highest revenue and highest profits to date and are proud of the work the team did together to accomplish all this.”

SDM 100 companies are ranked in the table above by the number of their residential subscribers (customers). Note that some of the larger companies such as ADT, Securitas and Brinks Home Security are not ranked, either because such detailed information is not publicly available or they did not report it to SDM. Companies that reported fewer than 100 residential subscribers are not included in this ranking.

// Source: 2023 SDM 100, SDM Magazine, May 2023

Top Companies Ranked by Residential Subscribers

Variations of this story abound throughout the comments from this year’s top 100 security dealers. But collectively, they did as well, and in many cases much better than last year, according to the numbers. This year’s group garnered $668 million in RMR — down from $702 million last year, but still the second highest in the last five years. Ninety-one percent of the companies reported at least some RMR growth in 2022. Both residential and non-residential sales revenue were up, as was total revenue, with residential sales up 17 percent, and non-residential up a whopping 40 percent over last year’s aggregate group number. Total subscribers continued its multi-year slide. But despite dueling headwinds of both supply chain shortages and inflation driving up costs, profits were up a healthy 6 percentage points over last year.

Read on to learn more about what these top security dealers experienced in 2022, as well as their predictions for where the path will lead in 2023.

Resi vs. Commercial

One trend that has been ongoing for many years is the increasing numbers of formerly residential-only security dealers getting into the commercial market to offset the challenges brought by DIY and the large competitors. This path, while having the benefit of diversification for security dealers, also means more to think about, both opportunity and challenge-wise.

On the residential side, results for 2022 were mixed, with more companies describing the pure residential market as soft, down or the same. But those who persevere in this market are seeing an uptick in certain technologies and smart home-type solutions. Builder programs were especially challenged as the year wore on with ever increasing interest rates slowing the new construction market. But not all experienced that.

SDM 100 companies are re-ranked in the table above by their 2022 total annual gross revenue, as reported to or estimated by SDM. Only two, ADT and Securitas Technology, exceeded $1 billion in revenue, while the remainder are in the millions, spanning from $720 million to over $2 million.

// Source: 2023 SDM 100, SDM Magazine, May 2023

Rank by Total Annual Revenue

Online Blogs

//

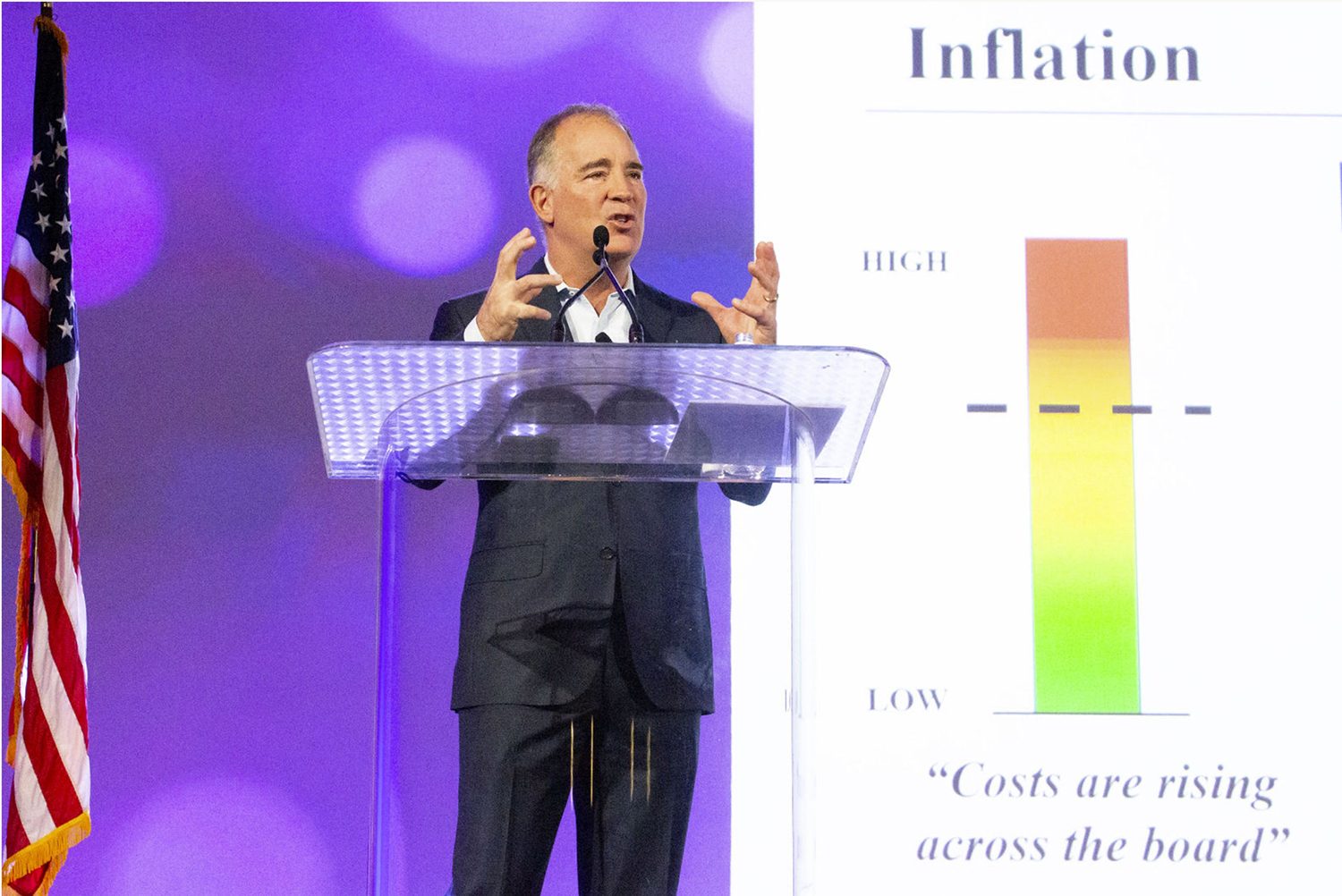

With many of this year’s SDM 100 companies expressing concerns about inflation, rising costs and price increases from their suppliers, Mike Barnes, president of Barnes Associates, addresses the need to consider raising installation AND monitoring prices.

Mark Melendes, managing director and commercial regional manager, Security Industry Group at CIBC, talks trends and deals they are seeing from their clients that will likely impact 2023.

SDM 100 Alphabetical Index

No. 7, Guardian Protection’s Vice President of Sales April Maloney, wrote: “The residential channel had average-minimal growth in 2022; however, there was increased interest in automation and video devices, enhancing the desire for a connected smart home. This contributed to additional services and recurring revenue in the small business and builder channels. While our builder channel started 2022 extremely strong with high home sales and buyers wanting monitored security and a connected smart home, the same channel experienced a decline in sales due to climbing interest rates causing significantly decreased home sales in the second half of the year. We continued to experience price increases from vendors, creating additional challenges in all our channels, but particularly in the builder channel — which already felt pinched by interest rates — causing builders to ask vendors for pricing reductions and concessions.”

No. 64, Crime Prevention Security Systems, wrote: “The market for residential security was very weak in 2022. We experienced many cancellations due to moves and finances. [But] the high-end residential market remained strong for us. We had several projects in new construction with custom and semi-custom builders.” Looking ahead, the company added, “Residentially, I believe we are going to see our traditional security numbers decline. I believe that homeowners in high-end homes will continue to invest in their security, Wi-Fi and entertainment. Video is strong in this market sector.”

The residential market faces headwinds but remains strong for seasoned operators.

— AMP Smart LLC

No. 61, Fleenor Security Systems, wrote that both its commercial and residential markets were good in 2022: “We found 2022 to be another strong year in both the residential and commercial spaces, keeping pace with 2021. We approached 2022 with some cautious optimism thinking the commercial and housing markets would see some considerable slowdowns due to high inflation and rapidly rising interest rates, but thankfully, this was not the case.”

AMP Smart, No. 19, summed up the residential space this way: “The residential market faces headwinds but remains strong for seasoned operators.”

Both residential and commercial customers were very interested in video solutions, according to multiple responses. But perhaps no two answers better demonstrate the dichotomy that was this year’s individual experiences than No. 53, Electronix Systems Central Station Alarms and No. 54, Valley Alarm.

Total annual revenue for the SDM 100 companies rose a whopping 32 percent in 2022 to its highest level since 2016. This year, ALERT 360, AMAROK and Vivint all elected not to report, but were offset by Securitas coming back to the ranking, along with Cook and Boardman, as well as a new company, Zeus Fire and Security. In addition, Pye-Barker made a number of acquisitions this year, resulting in substantial growth.

// Source: 2023 SDM 100, SDM Magazine, May 2023

Total Annual Revenue: $15.1 Billion

Total SDM 100 Annual Revenue ($ billions)

Adjacent on the SDM 100 ranking, their experiences of commercial trends were polar opposites. “Sales were up in 2022 compared to 2021 where shutdowns affected installation and service capabilities. The best growth was seen in fire systems whereas the worst growth was in CCTV,” wrote Electronix, which is based in New York.

On the other side of the country in California, Valley Alarm wrote: “The market was generally strong, but not much different than 2021. CCTV was strongest and analytics were key. Fire alarms were a little weaker than previous.”

Other companies faced issues due to the markets they specialized in, like No. 88, The Olivier Corporation, writing: “We are primarily focused on the corporate real estate market. While last year was hard for them, this year is tougher. We are trying to diversify.” Even so, the company noted they grew RMR by over 20 percent and had a better 2022 over 2021 overall.

SDM 100 dealer optimism has stayed steady from 2022 to 2023, with predictions remaining virtually unchanged from predictions in 2022. Of those who predict an increase, the average anticipated increase is 11 percent, down just 1 percent from last year.

// Source: 2023 SDM 100, SDM Magazine, May 2023

Dealers Say 2023 Revenue Will Be Up

There were many positives on the commercial side as well, with many pointing to access control, video, AI and return-to-work trends driving projects last year and this year.

“In its commercial and national account business units, Guardian experienced growth in most verticals in 2022 as employers made efforts to bring employees back to the office safely,” wrote Kevin Santelli, vice president — commercial and national accounts business. “These employers were also seeking new ways to efficiently manage multi-site locations and overcome labor shortages evidenced by new investments into AI and cloud-based systems.”

Challenges & Expectations

With so much upheaval and uncertainty in the past few years, it is particularly impressive what these top 100 companies have been able to accomplish, individually and collectively. But what do they anticipate for 2023 and beyond?

Not surprisingly, inflation concerns weighed heavy in many of their answers, and several expect some softening later in the year. No. 98, Enterprise Security Inc., described this as “the lurking economy and interest rates.” Labor shortages were another issue frequently mentioned.

Businesses in the security systems industry will need to stay vigilant and adapt to changing market conditions and trends to remain competitive in 2023. This will require ongoing investment in R&D, cybersecurity and supply chain management, as well as a focus on delivering innovative solutions that meet the evolving needs of customers.

— Minuteman Security & Life Safety

No. 78, Sonitrol of Evansville Inc., wrote: “We are struggling to hire new installers. We are significantly backed up and don’t see this changing anytime soon. The short supply of workers is driving up hourly rates quickly and will likely affect smaller companies the most.”

But overall, the SDM 100 companies continue to express confidence in their ability to weather any downturn that may occur or other obstacles that may be in their path.

No. 5, Pavion (formerly CTSI), wrote: “We have concerns about inflationary headwinds, continued supply chain delays, material costs increases and global unrest. We will continue to adapt and manage as these economic and market pressures adjust. We still anticipate significant organic and acquisitive growth through 2023.”

No. 25, General Security Inc., shared: “We expect the general economy and marketplace to soften a little in 2023. Headwinds from the housing market volume declines and rising interest rates should impact demand to some extent.”

The percentage of SDM 100 companies reporting increased profits rose 6 percentage points, with 52 percent of security dealers reporting an increase in profit margins in 2022, compared to 46 percent in 2021. Among businesses that improved, their average profit margin increase was an impressive 40 percent.

// Source: 2023 SDM 100, SDM Magazine, May 2023

Of the SDM 100 companies who reported their actual net profit margins, responses ranged from -1 percent to 55 percent, with the average net profit in 2022 of 14 percent — down slightly from 2021, when it was 16 percent.

// 2023 SDM 100, SDM Magazine, May 2023

Profits Increased In 2022

SDM 100 companies were asked, “Did your company’s net profit margin increase, decrease or stay about the same in 2022 compared with 2021?”

SDM 100 Average Net Profit Margin

SDM 100 companies were asked, “What was your company’s net profit margin in 2022?”

*average percentage, based on 66 responses

14%*

Minuteman Security & Life Safety, No. 47, listed several factors that will greatly impact business in 2023, including ongoing supply chain disruptions, labor shortages, cybersecurity, DIY and self-monitoring trends. But on the positive side, the company writes that current events will be a boon for the security industry: “Ongoing geopolitical tensions and social unrest may increase demand for security solutions and drive innovation in the industry. For example, recent mass shootings have led to increased demand for active shooter detection and response solutions. … Businesses in the security systems industry will need to stay vigilant and adapt to changing market conditions and trends to remain competitive in 2023. This will require ongoing investment in R&D, cybersecurity and supply chain management, as well as a focus on delivering innovative solutions that meet the evolving needs of customers.”

No. 60, Advanced Security Systems, summed up what many answers seemed to get at: “Supply chain issues continue to be a problem with no immediate end in sight. Also, inflation had made business less profitable as we struggle to hold prices to our customers competitive. We are tightening our belt as we brace for a possible recession. We continue to be optimistic as our industry has weathered ups and downs in the U.S. economy and continued to grow and thrive.”

No. 76, Dehart Alarm Systems Inc. noted an interesting phenomenon, which might explain why the predicted recession either won’t happen, or as experts suggest, will be a soft landing: “Even with inflation, the consumer has adjusted to this being the new norm. Unless there is a hard recession I believe the consumer will continue to purchase the services and products we offer.” SDM

Objective of the SDM 100

The SDM 100 has been published since 1991. Its primary objective is to measure consumer dollars gained by security companies, in order to present an account of the size of the market captured by the 100 largest providers. SDM 100 companies are ranked by their recurring monthly revenue. RMR is the revenue associated with the contractual agreement between a security company and its subscriber — derived from customer billing for services such as monitoring, contracted service/system maintenance, security-as-a-service and managed/cloud solutions, and leasing of security systems — and is typically the basis for valuation of a security company. RMR is the language of security company executives and is meaningful in comparative analysis among industry peers. Of the 100 security dealers ranked, 32 of them earned more than $1 million in RMR in 2022.

//

How to Use the SDM 100 Tables

The 2022 SDM 100 ranks U.S. companies that provide electronic security systems and services to both residential and non-residential customers. This ranking is based on information provided to or, in few cases, estimated by SDM. Ranked companies were asked to submit either an audited or reviewed financial statement, or a copy of their income tax return showing total gross receipts for the stated period. The vast majority of the firms ranked are privately held.

The main table, ranks 100 companies by their recurring monthly revenue (RMR) of December 31, 2022. The company with the highest RMR is ranked as No. 1, and so on. For each of the 100 companies, the following information is provided, from left to right:

- Current year rank, which is based on Dec. 31, 2022, RMR.

- Prior year rank.

- Company name, as used in the marketplace (doing business as), and headquarters location.

- Amount of RMR billed on Dec. 31, 2022.

- Percentage of RMR increase/decrease compared with Dec. 31, 2021.

- Number of subscribers (recurring-billable customers) at year-end 2022.

- Amount of sales revenue from residential system installations in 2022.

- Amount of sales revenue from non-residential system installations in 2022.

- Total gross revenue, in calendar-year or (the company’s) fiscal-year 2022 from security system sales/installation, services, leasing and monitoring.

- Number of full-time employees.

- Number of business locations, including headquarters.

SDM 100 companies are then re-ranked by several other criteria, including total annual gross revenue; residential subscribers; and non-residential sales revenue. See the report online at SDMmag.com/sdm100report for more data than presented here.

Note: An e following the figure indicates it is an SDM estimate.

To find a company by name, use the alphabetical index.

//

How to Purchase the SDM 100 Directory

Wouldn’t it be useful to have more information about each of the 100 companies ranked here? The 2022 SDM 100 Directory includes contact names, mailing addresses, telephone numbers, website URLs, branch office locations, product buyer names, installation data and more. The SDM 100 Directory comes in Microsoft Excel format. To order, contact Jackie Bean at 215-939-8967 or by e-mail to beanj@bnpmedia.com.